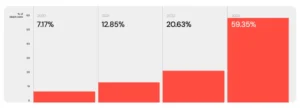

The latest crypto winter wiped out more than half of cryptocurrencies listed on CoinMarketCap, what appears to be a self-purification of the market ahead of a new rally, according to data compiled by AlphaQuest. The data shows that 2023 was the toughest year in the 2020-2023 cycle, as nearly 60% of coins bit the dust during that period.

Among dead coins, over 90% of the defunct coins met their end due to issues related to low liquidity and dwindling trading volume, indicative of waning investor interest. Furthermore, more than half of these projects ceased updating their websites, while 47.6% were delisted from CoinMarketCap. Additionally, slightly over 35% of the defunct coins exhibited complete inactivity across all accounts on social media.

“By analyzing social media activity, investors can stay informed and cautious in the world of cryptocurrency.”

AlphaQuest

Moreover, the research underscores a sobering reality: more than 70% (4,834) of crypto projects that emerged during the 2020-2021 bull run have met their demise, with over 30% becoming inactive shortly after the FTX crypto exchange filed for bankruptcy. AlphaQuest noted that the majority of these failed ventures (75%) were focused on the video and music sector, with an additional 75% comprising asset-backed stablecoins that faltered amid the bear market’s onslaught.